Health Shields and Wealth: My Real Talk on Beating Medical Cost Surprises

Dealing with medical expenses hit me harder than the illness itself. I never thought a hospital bill could shake my finances—until it did. That’s when I learned: protecting your health isn’t just about doctors and meds. It’s about how you structure your money. I tested strategies, made mistakes, and finally found a smarter way—not relying on luck, but on a solid plan. Let me walk you through what actually works. This isn’t a story about becoming rich or avoiding illness. It’s about building resilience so that when life throws a health challenge your way, your financial stability doesn’t crumble with it. Too many families face the same shock—walking into a hospital expecting care and walking out with a crisis no one saw coming. The truth is, medical costs are not just a health issue; they’re a wealth issue. And with the right mindset and tools, you can protect both.

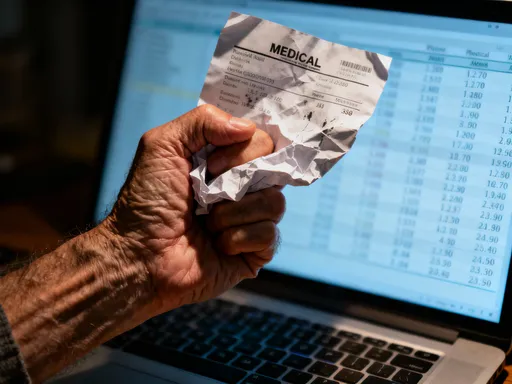

The Wake-Up Call: When Medical Bills Shattered My Financial Calm

The call came on a Tuesday morning. A routine blood test had revealed something unusual, and further scans confirmed a diagnosis I wasn’t ready to hear. At first, my focus was entirely on treatment—doctors, appointments, medications. But within weeks, another kind of stress began to build: the financial kind. The first bill arrived in the mail, then another, each one larger than the last. I had insurance, yes, but the fine print revealed gaps I hadn’t anticipated—deductibles, co-insurance, non-covered services. One procedure alone carried a $4,200 out-of-pocket cost. That number sat on the page like a sentence. I remember staring at it, heart pounding, wondering how we’d cover it without touching our retirement savings or dipping into the kids’ college fund.

What followed was a series of difficult conversations—about budget cuts, delayed home repairs, even putting off a family trip we’d been planning for years. The emotional toll of illness was hard enough, but the added pressure of financial uncertainty made recovery feel like an uphill battle on two fronts. I began to lose sleep, not just from physical discomfort, but from the fear of what might come next. What if I needed surgery? What if the treatment failed and required more intensive care? I realized then that I had been treating health and finances as separate domains, when in reality, they are deeply intertwined. My wake-up call wasn’t just about my body—it was about my entire approach to security. I had saved diligently, invested carefully, and believed I was prepared for life’s surprises. But I hadn’t planned for this kind of surprise. And I knew I wasn’t alone.

Research from the Kaiser Family Foundation shows that nearly half of U.S. adults have trouble paying medical bills, and about one in four report serious financial problems due to health costs. These aren’t people living paycheck to paycheck—they’re teachers, nurses, small business owners, people who consider themselves financially responsible. The lesson was clear: traditional budgeting isn’t enough. You need a proactive strategy that anticipates medical cost exposure, not one that reacts to it after the fact. That moment of crisis became the catalyst for change. I decided to take control—not just of my health, but of how I managed money in relation to it. I began researching, asking questions, and talking to financial advisors who specialized in healthcare planning. What I discovered reshaped my entire financial mindset.

Why Medical Costs Are a Silent Wealth Killer

Most people think of wealth in terms of income, savings, and investments. But few consider how quickly a health event can dismantle years of financial progress. Unlike a car repair or home renovation, medical expenses are unpredictable in both timing and magnitude. You can’t schedule a heart attack or a cancer diagnosis. And when they happen, the costs can spiral far beyond what insurance covers. A study published in the American Journal of Public Health found that medical issues contribute to over 60% of personal bankruptcies in the United States—even among those with health insurance. This isn’t about overspending or poor money management. It’s about systemic vulnerability.

The real danger lies in the gap between perception and reality. Many assume that having insurance means being protected. But high-deductible plans, co-pays, and non-covered treatments—such as certain medications, imaging tests, or alternative therapies—can leave patients responsible for thousands of dollars. For example, a single MRI can cost over $1,000 out of pocket, and chemotherapy regimens often involve multiple rounds of treatment, each with its own set of fees. These expenses don’t occur in isolation. They accumulate during a time when earning capacity may be reduced due to illness or caregiving responsibilities. Lost income, combined with rising medical bills, creates a double financial blow.

What makes this particularly insidious is how quietly it happens. Unlike a stock market loss, which shows up immediately on a portfolio statement, medical debt erodes wealth gradually. You pay a little here, defer a bill there, take out a medical credit card, and before long, you’re trapped in a cycle of interest and stress. The long-term impact is profound: delayed retirement, reduced home equity, and diminished ability to support children or aging parents. More importantly, financial strain can actually worsen health outcomes. Studies show that patients who worry about costs are more likely to skip medications, delay follow-up care, or avoid necessary procedures—all of which increase the risk of complications and further expenses. In this way, financial insecurity becomes a health risk in itself.

The solution isn’t to avoid medical care—it’s to reframe how we prepare for it. Wealth preservation isn’t just about growing assets; it’s about protecting them from unexpected shocks. And healthcare is one of the most common and costly shocks families face. The key is to stop viewing medical spending as an isolated expense and start treating it as a core component of financial planning. Just as you wouldn’t drive a car without insurance, you shouldn’t navigate life without a strategy to manage health-related financial risk. This means building systems that absorb cost surprises before they reach your savings or investments.

Asset Diversification: Not Just for Stocks, But for Health Resilience

When most people hear “diversification,” they think of spreading investments across stocks, bonds, and real estate to reduce market risk. But I learned that diversification applies just as powerfully to health financial planning. The goal isn’t just to grow wealth—it’s to ensure that wealth remains accessible and usable when you need it most. Early in my journey, I made the mistake of keeping all my emergency funds in a single savings account. It felt safe, but when the bills came, I realized that safety came at a cost: liquidity under pressure. I had to withdraw large sums at once, disrupting my long-term savings rhythm and losing potential interest.

That’s when I adopted a more strategic approach—diversifying my assets not just by type, but by function. I created three distinct buckets: one for immediate access, one for mid-term stability, and one for long-term growth. The first bucket holds six months’ worth of living expenses, including a dedicated portion for potential medical costs, kept in a high-yield savings account. This ensures that if a health issue arises, I can cover deductibles, co-pays, or urgent procedures without selling investments. The second bucket includes protected assets like life insurance with critical illness riders and long-term care coverage. These products don’t just provide death benefits—they offer living benefits that can be accessed during serious health events. For instance, some policies allow you to withdraw a portion of the death benefit if diagnosed with a qualifying condition, giving you cash when you need it most.

The third bucket consists of diversified, income-generating investments—such as dividend-paying stocks, rental properties, and fixed-income securities. These aren’t meant for quick spending, but they provide a steady stream of cash flow that can support extended recovery periods. If I were unable to work for several months, this income could help cover household bills, allowing me to focus on healing rather than financial survival. By spreading my resources across these layers, I’ve created a financial ecosystem that’s resilient to health shocks. No single point of failure can bring down the whole system. This approach doesn’t eliminate risk, but it reduces dependence on any one source of funds during a crisis.

What’s crucial is aligning each asset class with a specific purpose. Cash is for immediacy, insurance is for protection, and investments are for sustainability. Too often, people treat all money the same, moving funds impulsively when stress hits. But when you assign roles to your assets, you make better decisions under pressure. You’re less likely to panic-sell stocks during a market dip or raid a 401(k) and face penalties. Instead, you have a plan that guides your actions. Diversification, in this sense, is not just a financial strategy—it’s a form of emotional resilience. Knowing you have multiple layers of support allows you to face health challenges with greater calm and clarity.

Building a Health-Financial Firewall: The 3-Layer Protection Model

After months of research and trial, I developed a personal system I now call the 3-Layer Protection Model. It’s designed to act like a firewall—stopping financial damage before it spreads. Each layer serves a distinct purpose, and together, they create a comprehensive defense against medical cost surprises. The first layer is the Immediate Response Fund. This is a fully liquid, easily accessible savings account dedicated solely to health emergencies. I keep enough to cover my annual insurance deductible plus an additional 20% for unexpected charges. It’s automated—every month, a fixed amount transfers from my checking account, so I’m consistently building it without having to think about it. This fund handles the first wave of expenses: ER visits, lab tests, prescription costs. Because it’s separate from my regular emergency fund, I don’t have to scramble to reallocate money when a health issue arises.

The second layer is Enhanced Insurance Coverage. I reviewed my existing health plan and added targeted upgrades that fill common gaps. For example, I purchased a hospital cash plan, which pays a fixed daily benefit if I’m admitted. That money can be used for anything—transportation, meals, even lost wages—giving me flexibility during recovery. I also added a critical illness rider to my life insurance, which provides a lump sum payment if I’m diagnosed with conditions like cancer, stroke, or heart attack. These products aren’t meant to replace comprehensive care—they’re designed to cover what insurance doesn’t. They act as force multipliers, turning small premiums into significant support when needed. Importantly, I made sure these policies were from reputable providers with clear terms and no hidden exclusions.

The third layer is Long-Term Financial Resilience. This includes my diversified investment portfolio and passive income streams. The goal here isn’t immediate access, but sustained support. If a health issue requires me to reduce work hours or take unpaid leave, this layer ensures I can maintain my standard of living without liquidating assets at a loss. I’ve structured my portfolio to include stable dividend payers and low-volatility ETFs that generate consistent returns. I also have a small rental property whose income helps offset fixed expenses. This layer isn’t about getting rich—it’s about staying stable. Together, the three layers form a cohesive system. The first absorbs the initial shock, the second provides targeted support, and the third ensures long-term continuity. It’s not a one-size-fits-all solution, but it’s adaptable. You can scale it based on your income, family size, and risk tolerance.

What makes this model effective is its proactive nature. It doesn’t wait for disaster to strike—it prepares for it in advance. And because each layer has a defined role, decision-making during a crisis becomes simpler. You’re not guessing what to do—you’re following a plan. This reduces stress, prevents impulsive choices, and preserves both health and wealth. I’ve shared this model with friends and family, and several have customized it to fit their lives. One neighbor used it to avoid taking on debt after a knee surgery. Another colleague used the hospital cash benefit to cover childcare while recovering from a procedure. These aren’t extraordinary outcomes—they’re the result of ordinary planning done consistently.

Smart Moves That Cut Costs Without Risking Care Quality

While having a financial safety net is essential, I also learned that everyday choices can significantly reduce medical spending—without compromising care. One of the first changes I made was switching to in-network providers. It sounds simple, but the cost difference can be staggering. An out-of-network specialist might charge double what an in-network one does for the same service. I now verify network status before every appointment and ask for referrals within my plan. I also started using telehealth for routine follow-ups. What used to require a half-day off work, gas, parking, and childcare now takes 15 minutes from home. The convenience is obvious, but the financial benefit adds up over time.

Another powerful tool is bill auditing. I began reviewing every medical statement line by line, just as I would a credit card bill. I discovered duplicate charges, incorrect coding, and services I never received. In one case, I was billed for a lab test that had already been covered under a preventive care package. After appealing, the charge was removed. I learned to ask questions—politely but firmly. I also discovered that many hospitals and clinics offer financial assistance programs or payment plans with zero interest. I negotiated a six-month plan for a remaining balance, which made it manageable without straining my budget.

Preventive care became a cornerstone of my strategy. Annual screenings, vaccinations, and lifestyle changes—like improving diet and increasing physical activity—may seem minor, but they prevent major costs down the road. A study from the Centers for Disease Control and Prevention shows that preventive services can reduce long-term healthcare spending by up to 10%. I now treat these appointments as non-negotiable, scheduling them well in advance. I also use wellness programs offered through my employer, which provide incentives for healthy behaviors. These small, consistent actions haven’t just saved money—they’ve improved my overall health, reducing the likelihood of future crises.

The key insight is that cost-saving doesn’t mean cutting corners. It means being intentional. It’s about using the system wisely, not fighting against it. When you approach healthcare with financial awareness, you become a more informed and empowered patient. You don’t accept bills blindly. You question, compare, and choose. You plan ahead. These habits don’t require expertise—just attention. And over time, they build a culture of financial and physical wellness in your household.

The Psychology of Financial Readiness: Overcoming "It Won’t Happen to Me"

Perhaps the biggest obstacle I faced wasn’t financial—it was mental. For years, I operated under the assumption that serious illness happened to other people. I was healthy, active, and careful. The idea of a major medical event felt distant, almost unreal. That mindset, I’ve come to realize, is one of the most dangerous financial risks of all. Denial delays preparation. It leads to underinsurance, inadequate savings, and last-minute scrambling. I was lucky that my diagnosis came at a time when I still had some resources to fall back on. Others aren’t so fortunate.

Breaking through that denial required a shift in perspective. I had to accept that risk is not a sign of weakness—it’s a fact of life. Everyone ages. Everyone faces health challenges. The difference is in preparation. Once I embraced that reality, I stopped fearing the “what ifs” and started planning for them. I began small: opening the dedicated health savings account, reviewing my insurance policy, scheduling a preventive screening. Each step built confidence. I wasn’t trying to predict the future—I was building resilience against it.

This psychological shift transformed my relationship with money. I no longer saw saving as deprivation. I saw it as protection. I stopped thinking of insurance as an expense and started seeing it as a tool. The emotional payoff was significant. I felt calmer, more in control. Even when new health concerns arose, I approached them with a sense of preparedness rather than panic. That peace of mind is something no diagnosis can take away. It’s available to anyone willing to confront the truth and take action. Financial readiness isn’t about being perfect. It’s about being consistent. It’s about making progress, not waiting for perfection.

Making It Stick: How to Build and Maintain Your Health-Wealth System

The final piece of the puzzle was sustainability. I realized that even the best plan fails if it’s not maintained. Early on, I was highly motivated—driven by recent experience and fresh fear. But motivation fades. What lasts is routine. So I built systems that require minimal effort but deliver maximum impact. I set up automatic transfers to my health emergency fund, just like a utility bill. I scheduled annual insurance reviews on the same day as my birthday, making it a personal ritual. I track medical spending in my budgeting app, treating it like groceries or utilities. These small habits keep the system alive without demanding constant attention.

I also treat financial check-ins like doctor appointments—non-negotiable and regular. Every quarter, I review my coverage, assess my fund balances, and adjust for life changes like income shifts or family growth. If I get a raise, I increase my health savings contribution. If a new medication enters my regimen, I verify coverage. This ongoing maintenance ensures the system evolves with my needs. I’ve also involved my family. We talk openly about health and money, so everyone understands the plan and their role in it. My spouse knows where the documents are. My children understand why we prioritize certain expenses. This shared awareness creates a household culture of preparedness.

Looking back, I wouldn’t wish my diagnosis on anyone. But I’m grateful for what it taught me. I now see health and wealth not as separate goals, but as interconnected pillars of a secure life. By aligning them, I’ve built a level of resilience that goes beyond money. It’s peace of mind. It’s the ability to face uncertainty with courage, knowing I have a plan. You don’t need a crisis to start. You just need awareness, intention, and a few smart, consistent steps. The goal isn’t to eliminate risk—it’s to manage it wisely. And in doing so, you protect not just your finances, but your future.